Checking Reports

Step-by-Step Guide to the Credit Report Review Process

Reviewing your credit report is an essential part of maintaining healthy financial habits. Regularly checking your report ensures that your credit history is accurate and helps you catch potential errors or signs of identity theft. Here’s a step-by-step guide to reviewing your credit report, empowering you to take control of your financial health.

Step 1: Request Your Credit Report

The first step in the credit report review process is obtaining your credit report. In many countries, you are entitled to a free credit report from major credit bureaus once a year. In the U.S., for instance, you can request your report from the three main bureaus—Equifax, Experian, and TransUnion—through AnnualCreditReport.com.

- How to Request: Visit the official website of your country’s credit reporting agencies or use authorized services to access your report. You may need to provide personal information like your Social Security number or identification details to verify your identity.

Step 2: Review Personal Information

Once you have your credit report, start by reviewing the personal information section. This part of the report contains your name, current and previous addresses, phone numbers, date of birth, and employer details.

- What to Look For: Ensure that all personal details are accurate and up to date. Incorrect information, such as an address you’ve never lived at, could be a sign of fraud or identity theft. If you spot errors, contact the credit bureau to correct them immediately.

Step 3: Examine Credit Accounts

Next, review the list of credit accounts, also known as trade lines. This section provides details about your current and past credit accounts, including credit cards, loans, mortgages, and other lines of credit.

- What to Look For: Check that the account balances, payment history, and credit limits are accurate. Pay attention to any unfamiliar accounts, as these could indicate fraudulent activity. Verify that closed accounts are correctly reported and that any paid-off debts are marked as such.

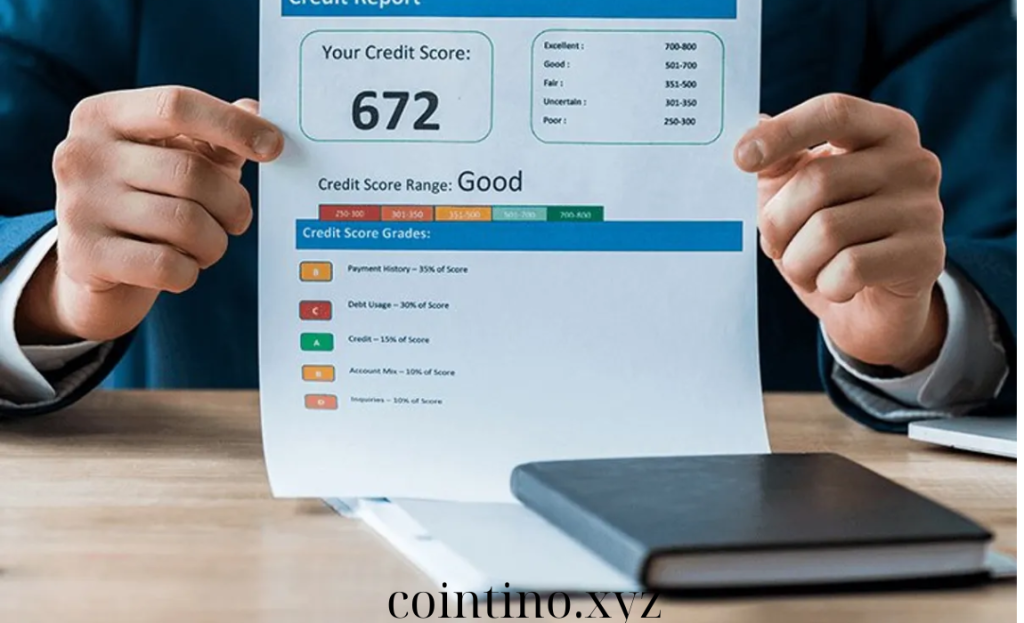

Step 4: Check Payment History

Your payment history is one of the most critical components of your credit report. This section shows whether you’ve made on-time payments for each of your accounts or if there are any late payments or defaults.

- What to Look For: Ensure that your payment history is accurate and up to date. If you spot any missed or late payments that are incorrect, dispute them with the credit bureau. On-time payments are crucial for maintaining a good credit score, so it’s important to correct any errors.

Step 5: Review Credit Inquiries

Credit inquiries occur when a lender, financial institution, or you request to check your credit report. There are two types of inquiries—hard inquiries, which occur when applying for credit, and soft inquiries, which happen when you or a company checks your credit for non-lending purposes.

- What to Look For: Review all hard inquiries listed on your report. Ensure that each inquiry was authorized and that you recognize the source. Multiple hard inquiries within a short period can negatively impact your credit score, so it’s important to verify their accuracy.

Step 6: Inspect Public Records

Some credit reports may contain public records, such as bankruptcies, tax liens, or court judgments, which can significantly affect your credit score. These records typically remain on your report for a set number of years, depending on the nature of the event.

- What to Look For: Check that any public records listed are correct and that their timeframes for removal are accurate. If any records are outdated or inaccurate, file a dispute to have them removed from your report.

Step 7: Look for Negative Information

In addition to public records, negative information like late payments, charge-offs, or accounts sent to collections can appear on your credit report. These marks can lower your credit score and stay on your report for up to seven years.

- What to Look For: Confirm that any negative items listed are accurate. If you find any outdated or incorrect negative information, such as collections that have been paid off, dispute them to ensure they are removed or corrected.

Step 8: Review Debt-to-Credit Ratio

Your debt-to-credit ratio, also known as credit utilization, compares your current debt to your total available credit. This ratio plays a significant role in determining your credit score, as high utilization can indicate financial instability.

- What to Look For: Ensure that your credit limits and balances are reported correctly. Aim to keep your credit utilization below 30% of your available credit limit to maintain a healthy score. If the ratios are inaccurate, contact your creditor and the bureau for corrections.

Step 9: Identify Errors and Dispute Them

If you spot any inaccuracies, such as incorrect account balances, fraudulent accounts, or erroneous late payments, it’s essential to file a dispute with the credit bureau that issued the report. The bureau is required to investigate your claim, typically within 30 days, and correct any verified errors.

- How to Dispute: Most credit bureaus offer an online dispute process, but you can also file a dispute by mail. Be sure to provide supporting documentation, such as payment receipts or account statements, to back up your claim.

Step 10: Monitor Your Credit Regularly

Once you’ve reviewed and disputed any errors on your credit report, it’s important to continue monitoring your credit over time. Regular reviews can help you stay on top of changes, detect potential fraud early, and ensure your credit score remains in good standing.

- How to Monitor: Consider signing up for credit monitoring services or setting reminders to check your credit report every few months. Many credit card companies and financial institutions also offer free credit score updates to help you track your progress.

Final Thoughts

The credit report review process is a critical step in managing your financial health. By regularly checking your report, verifying the accuracy of the information, and promptly disputing any errors, you can maintain a healthy credit score and safeguard your financial future.