Acrylic painting is one of the most versatile and accessible mediums, offering endless possibilities for creating stunning, dimensional artwork. Unlike oils, acrylics dry quickly, making mixing and blending a bit more challenging but also opening the door to unique techniques. Mastering how to mix and blend acrylics can dramatically enhance the depth, texture, and overall […]

Author Archives: admin

A strong credit score can open the door to better loan rates, premium credit cards, and more favorable financial terms. Optimizing your credit score isn’t just about paying bills on time; it involves a strategic approach to managing debt, credit utilization, and payment history. By following a few essential tips, you can steadily improve your […]

A strong credit score is essential for financial well-being. It affects your ability to secure loans, mortgages, and even rental agreements, often determining the interest rates you’ll receive. If your credit score isn’t where you’d like it to be, don’t worry—there are plenty of actionable steps you can take to improve it. In this guide, […]

Your credit score is one of the most important numbers in your financial life. A good credit score can help you secure loans at lower interest rates, get approved for better credit cards, and even improve your chances of renting an apartment or getting a job. If you’re looking to improve your score, these proven […]

A high credit score is crucial for securing favorable loan terms, credit card approvals, and even better insurance rates. Whether you’re looking to improve your score before applying for a loan or simply aiming for financial security, taking steps to boost your credit score can have a significant impact. Fortunately, there are several proven strategies […]

Maintaining a healthy credit score is crucial for financial well-being. Your credit score impacts everything from loan approvals and interest rates to your ability to rent an apartment or even get a job. Regular credit checks allow you to stay informed about your financial standing, catch potential issues early, and take steps to improve your […]

Your credit report is more than just a summary of your financial history—it’s a crucial tool that can impact your ability to secure loans, rent an apartment, or even get a job. Ensuring that your credit report is accurate is essential for protecting your financial future. Mistakes on your credit report can lead to higher […]

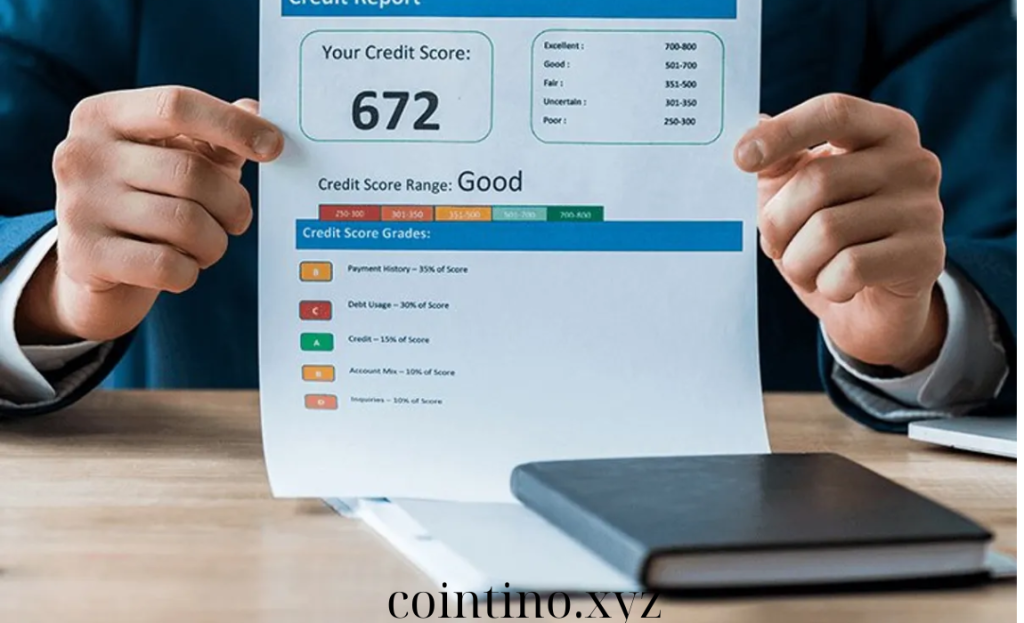

Credit scores play a pivotal role in your financial life, influencing everything from loan approvals to interest rates and even job applications in some industries. Understanding how credit scores are categorized and what each range means can help you make informed financial decisions and improve your creditworthiness. Here’s a comprehensive guide to credit score classification […]

Reviewing your credit report is an essential part of maintaining healthy financial habits. Regularly checking your report ensures that your credit history is accurate and helps you catch potential errors or signs of identity theft. Here’s a step-by-step guide to reviewing your credit report, empowering you to take control of your financial health. Step 1: […]

Monitoring your credit reports is crucial for maintaining strong financial health. Your credit report contains a detailed record of your credit history, including loans, credit cards, and payment behaviors. Regularly reviewing your credit report helps you spot inaccuracies, detect fraud, and stay informed about your credit standing. Here’s why monitoring your credit report is essential […]