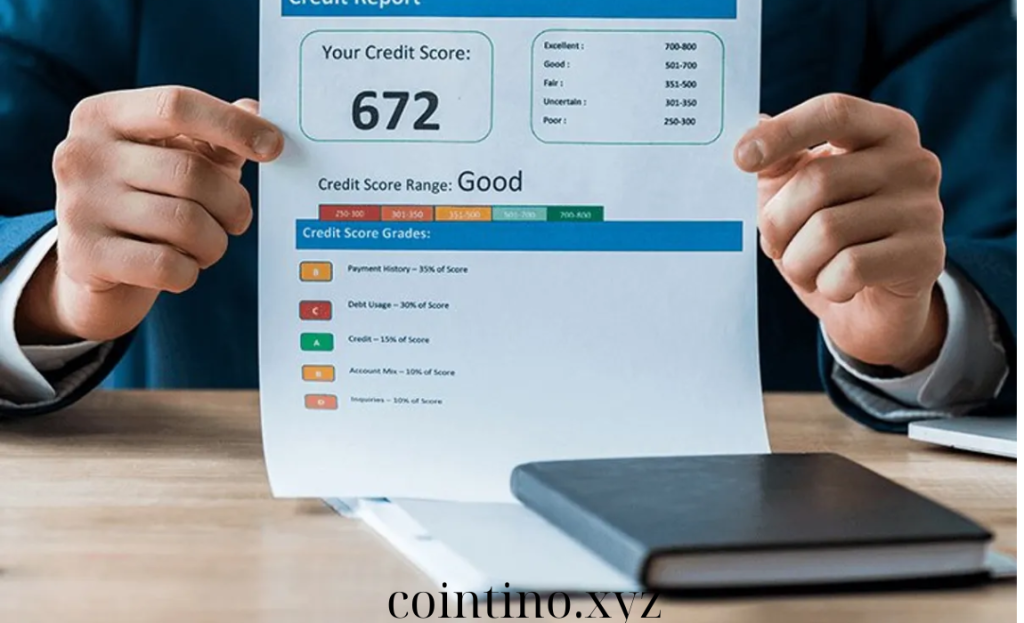

Maintaining a healthy credit score is crucial for financial well-being. Your credit score impacts everything from loan approvals and interest rates to your ability to rent an apartment or even get a job. Regular credit checks allow you to stay informed about your financial standing, catch potential issues early, and take steps to improve your […]

Category Archives: Checking Reports

Your credit report is more than just a summary of your financial history—it’s a crucial tool that can impact your ability to secure loans, rent an apartment, or even get a job. Ensuring that your credit report is accurate is essential for protecting your financial future. Mistakes on your credit report can lead to higher […]

Reviewing your credit report is an essential part of maintaining healthy financial habits. Regularly checking your report ensures that your credit history is accurate and helps you catch potential errors or signs of identity theft. Here’s a step-by-step guide to reviewing your credit report, empowering you to take control of your financial health. Step 1: […]

Monitoring your credit reports is crucial for maintaining strong financial health. Your credit report contains a detailed record of your credit history, including loans, credit cards, and payment behaviors. Regularly reviewing your credit report helps you spot inaccuracies, detect fraud, and stay informed about your credit standing. Here’s why monitoring your credit report is essential […]

Regularly checking your credit report is one of the most effective ways to stay on top of your finances and ensure your credit health remains strong. Your credit report contains vital information about your financial habits, including your payment history, outstanding debts, and any inquiries made about your credit. By monitoring this information, you can […]